Bangalore Investment Property made easy with Chenthoor Living

Build Generational Wealth -Investment Opportunities in Bangalore

Join us now to avail a special opportunity to be a part of real estate made easy revolution

Investment Opportunities In Bangalore

Why Invest in Serviced Apartments?

Better Returns

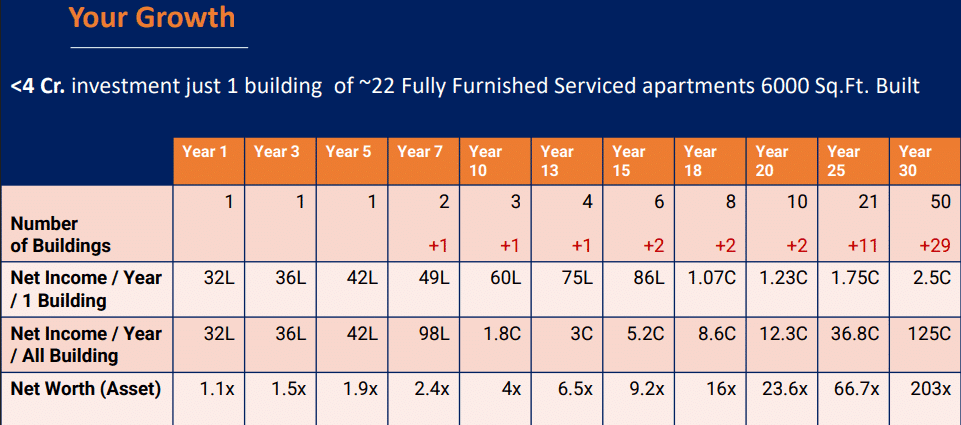

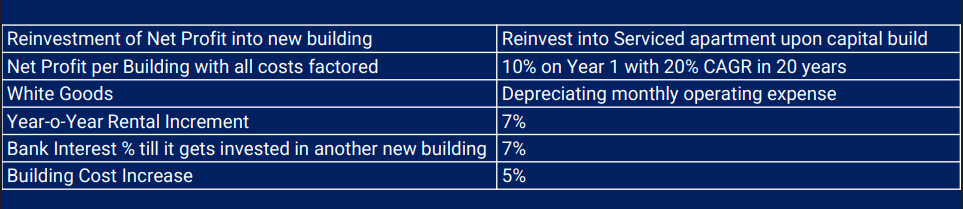

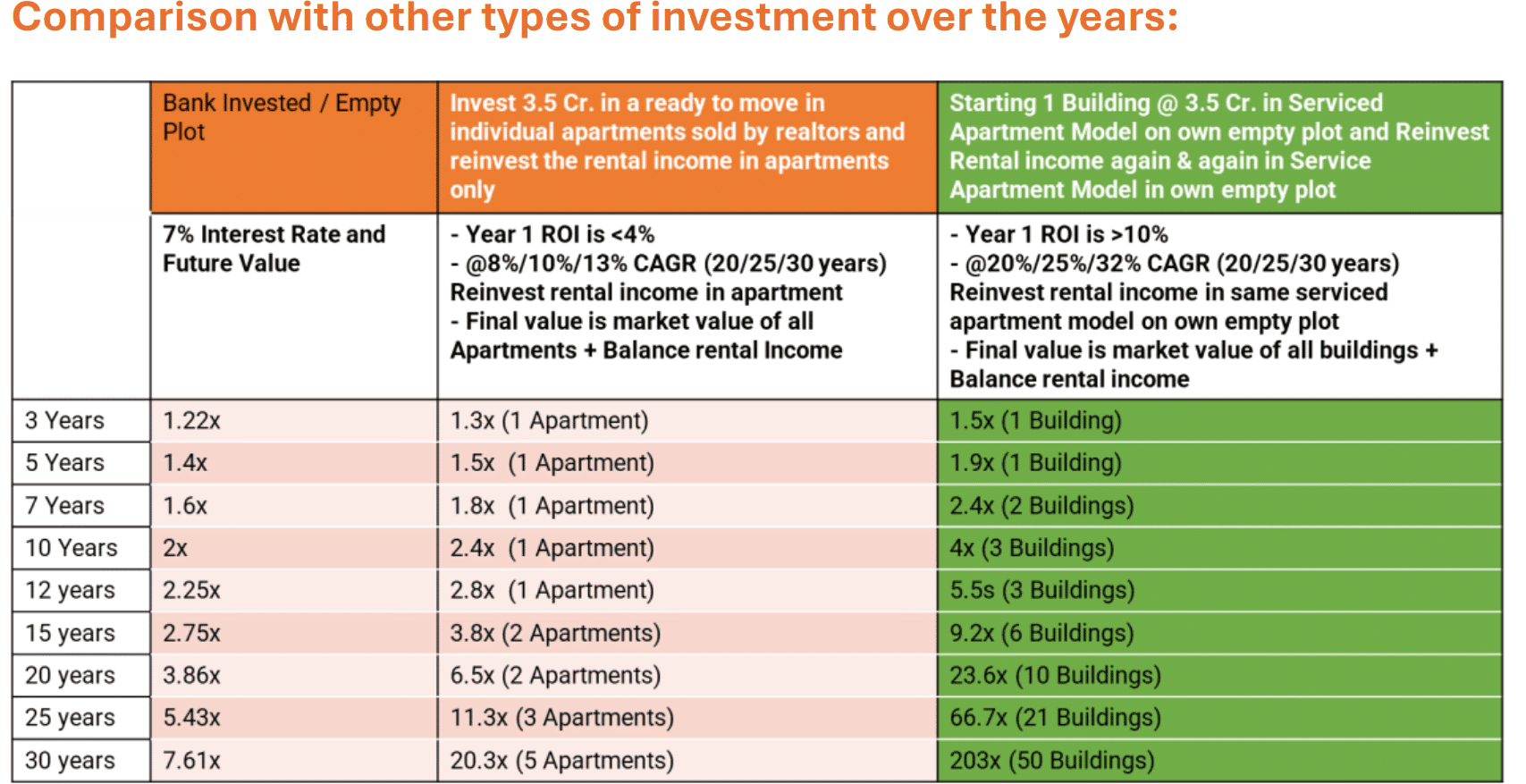

>20% CAGR compared to 7% Bank Return in 20 years.

Expert Property Management

Our team of dedicated Business Managers are committed to orchestrating seamless operations, and using their expertise to ensure a robust return on investment

What we do for you

Land and Building is yours; We just manage your asset for lifetime to create maximum wealth for you

What we have done till date :

Happy tenants

Project Complete

Registered Member

Trusted Partners

Serviced Appartements In Bangalore

Why invest in serviced apartments in Bangalore? Here are the key points to consider:

- Serviced apartments provide higher rental yields compared to traditional residential properties, often delivering 10-15% more rental income. This is because they come fully furnished with hotel-like amenities such as housekeeping, security, and concierge services, which attract premium tenants willing to pay more for convenience and comfort.

- Bangalore investment property demand is rising steadily due to the city’s robust IT sector, multinational corporations, and startup culture. This creates a strong market for flexible and short-to-medium-term stay options, making serviced apartments highly sought after by corporate travelers, expatriates, and young professionals. The consistently high occupancy rates of around 80-90% reflect this growing demand.

- One standout advantage of serviced apartment investments is professional property management. Expert operators take care of maintenance, tenant sourcing, bookings, and day-to-day management, significantly reducing the investor’s burden and ensuring a hassle-free income stream.

- Bangalore investment opportunities in serviced apartments are especially promising because the city’s ongoing infrastructure development, metro expansion, and commercial growth are continuously boosting property values. Investors can enjoy both steady rental income and strong potential for capital appreciation.

- Additionally, serviced apartments offer certain tax benefits and financing options through home loans, which make them accessible and financially viable for a wide range of investors. This flexibility allows investors to diversify their real estate portfolios while enjoying relatively lower risks compared to other investment avenues.

“Overall, serviced apartment opportunities in Bangalore combine modern lifestyle demand, robust rental returns, and professional management to create a compelling investment option for real estate investors.”

Refer to this link:-Economic Times Article On Serviced Apartment

How it works

This isn’t a short-term pitch — it’s a long-horizon, asset-backed growth strategy that

turns idle land into an engine of long-term wealth and passive income.

Initial Building Construction:

We help you plan and construct an optimal fully furnished residential apartment building (~20 units / ~5500 Sq.Ft.) on your land.

Lifetime Income Generation:

We manage the property end-to-end under our established brand, ensuring high-quality tenants and stable returns.

Reinvestment Model:

As rental income accrues, we assist you in channelling it into new similar properties, compounding the benefits.

Ownership Stays with You:

You retain 100% ownership of the property. We operate purely as your long-term partner, earning a modest share of the net rental profits.

Frequently Asked Questions

Here are some the common questions asked to us , hope it helps you !!

What is the minimum capital required to start investing in serviced apartments?

How is the rental income from the serviced apartments managed?

Can I exit the investment easily if needed?

What if I already own land – can I still invest?

What kind of returns can I expect compared to traditional investments?

How are operational risks managed in this investment model?

Invest with us now !!

Build Generational Wealth (50+ times in 20 years) with a Fully Furnished Residential

Apartment — Asset Stays Entirely in Your Name; (Starting Capital Required: Less

than ₹4 Crores)